The investing world is evolving incredibly fast. A wild and emotional 2021 introduced meme-investing, new crypto assets, NFTs, and a rabbit hole of many more innovations riddled with excitement, uncertainty, and fear. Unfortunately, FOMO(fear of missing out) makes it easy to be pulled into these assets, especially for beginners. That’s is why it’s crucial, now more than ever, to keep your eyes open to protect yourself from making less-than-ideal investment decisions. So here are 3 dangerous financial trends to avoid going into 2022.

In This Article

1. YOLO(ing) into the market

We all love some Tesla, bitcoin, or even some Dogecoin. The returns on these investments have been remarkable, and future speculative gains irresistible. So what are YOLOers doing? They’re investing as much as possible(including borrowed money) into these multi-baggers, hoping they’ll keep running (to the moon!) and that they’ll soon be millionaires. After all, stonks only go up, right?

Well, wrong! Stocks don’t always go up.

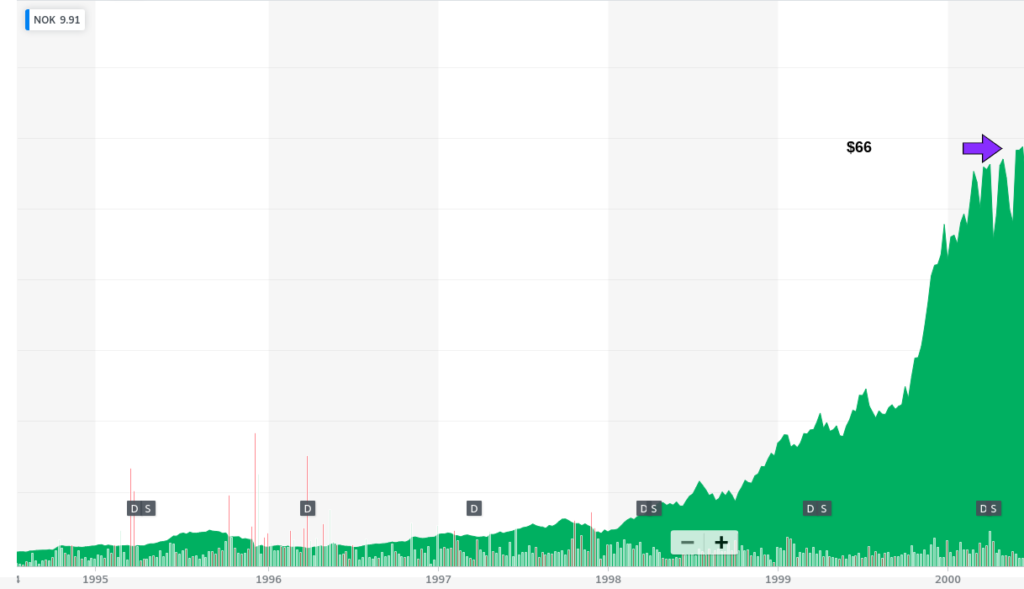

Here’s an excellent example of a stock that gave up all its gains contrary to everyone’s expectations: Nokia, the world’s largest cell phone company in the world, in 1998. The company was growing at a staggering rate; it was unstoppable. At its peak, the stock traded at $66 and even claimed a blue-chip status.

Read More: How to Prepare for a Stock Market Crash In 2022

The chart below shows Nokia’s soaring trajectory in 2000. Everyone was ecstatic as the stock soared ‘to the moon’.

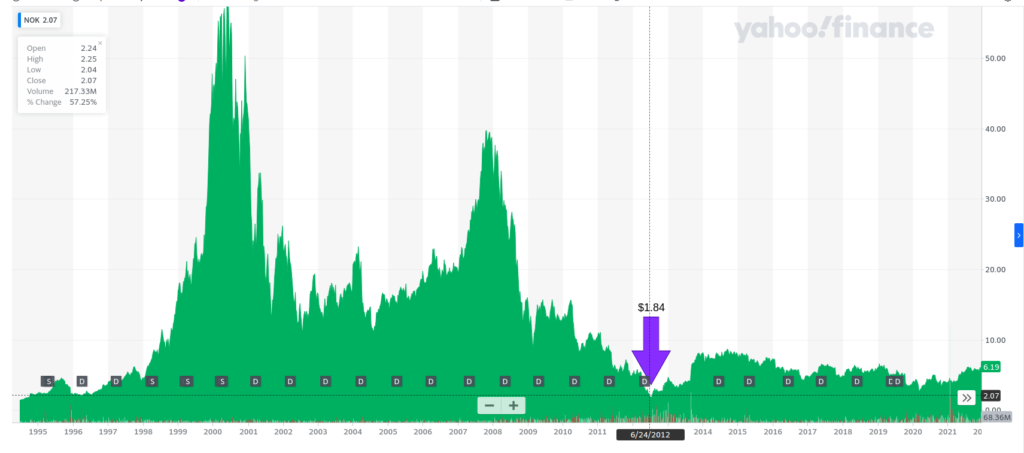

However, Nokia’s story changed pretty fast, and within a few years, it was trading at less than $2. Below is an update of the stock after the year 2000.

Now think about this: if you held a single share of Nokia at its peak, it was worth $66, but just a few years later, it was worth $1.84. It sounds like a tolerable loss, right? But what if you held 1000 shares of Nokia or your portfolio comprised of 90% Nokia stock? Your net wealth would have been decimated. That’s the risk of over-concentration.

Over concentration feels great when it’s working, but it can be absolutely devastating when it starts going in the wrong direction for you.

Read More: 3 Cheap Growth Stocks to Buy Now

So, if you already have an over-concentration in one stock/asset, you need to develop a tax-efficient strategy to diversify your portfolio. Then, you don’t have to sell and incur tax liabilities. Instead, you could decide to save aggressively and invest the money into other stocks or assets.

2. Market fear-mongering

All financial news headlines currently seem to be warning of an impending market crash in 2022. But, of course, it’s nothing new; they did it in 2020, 2021, and this time it won’t be any different.

“If it bleeds, it leads” is the age-old mantra that drives the news media.

Their main goal is to generate as many clicks and views as possible. And they do so by exploiting people’s fears and worries, such as

- their ability to make ends meet

- declines on their retirement accounts

It’s easy to see why the news media loves predicting market crashes and recessions even though they rarely get it right. Clickbaity recession headlines stir up fear and create a sense of urgency. Not only could they cause the decline of millions of retirement accounts, but also lead to millions of people losing their jobs and livelihoods.

Read More: 6 Best Paying Jobs in Tech That Don’t Require Coding in 2022

While it’s okay to stay up to date with market events, beware of the danger of media overconsumption. The media makes it look like we’re always on the verge of a market crash or even a recession, which can cause analysis paralysis and stop you from investing.

3. Alternative investments

In times of fear, investors “flee to safety,” meaning they look for alternative assets whose value will not be affected if a market crash or a recession occurs.

Read More: Should You Invest in Bitcoin or Other Cryptocurrencies?

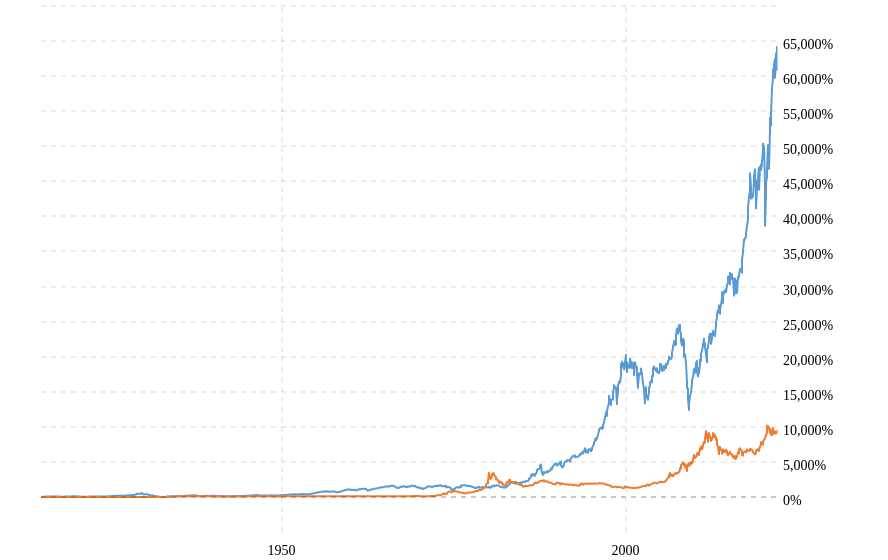

Gold and, at times, silver have provided a safe haven for investors for many years. They’re seen as “the world is coming to an end” kind of investment that can protect your wealth from market conditions.

While it’s okay to have gold or silver as a small part of your portfolio, it’s unfortunate when they’re pitched as primary investments. Fundamentally, gold is not an attractive asset and has consistently underperformed the broader market for many years.

With all the doom and gloom predictions for 2022, it’s understandable to want to protect your wealth by buying gold or silver. However, ensure that your decision is based on fundamentals and not fear.

Conclusion

The above trends seem to be taking root in the news media and among investors. Please don’t fall for any of them. Investing is a slow but sure kind of game and should never be driven by greed or fear.

So here’s my simple plan for 2022:

- Develop an investing strategy informed by research of asset fundamentals.

- Stick to the plan

- Avoid succumbing to fear