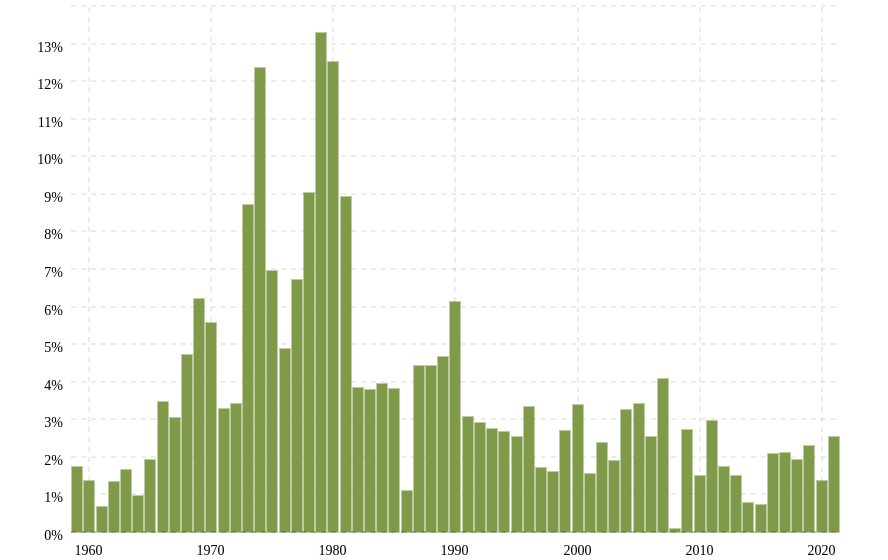

Inflation has been the least of our worries for the last two and a half decades as the economy has experienced mild inflation, averaging about 2%.

Recently though, inflation has been a huge cause for concern, with prominent investors like Warren Buffett, Charlie Munger, Ray Dalio, and Michael Burry issuing warnings of impending inflation.

In This Article

What Top Investors are saying

“At the end, if you print too much money, you end up with something like Venezuela.” Charlie Munger.

“We are seeing substantial inflation. We are raising prices. People are raising prices to us, and it’s being accepted. The economy is red hot. Everybody’s got more cash in their pockets.” Warren Buffett.

“Now that the economy is rebounding, inflation pressures are rebounding.” Ray Dalio.

“Prepare for inflation. Re-opening & stimulus are on the way. History is not useless… inflation is more relevant today than one might think.” Michael Burry

Michael Burry is well known for predicting the 2008 mortgage crisis well in advance and was profiled in the book “The Big Short” by Michael Lewis.

What is inflation? How do you calculate inflation?

Inflation refers to the rise in the prices of goods and services in an economy, consequently decreasing the value of a currency.

In other words, when prices rise, the amount of goods a dollar can buy decreases. As such, the purchasing power of a dollar reduces.

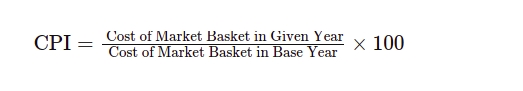

Consumer Price Index(CPI) is the most frequently used statistic to measure inflation.

CPI is calculated by finding the average price change in a basket of essential consumer goods and services, including food, transportation, and medical care.

The Bureau of Labor Statistics (BLS) determines the base year. For example, CPI data for 2017 and 2018 were based on data collected in 2014 and 2015.

According to BLS, In April 2021, the Consumer Price Index increased 0.8% on a seasonally adjusted basis after rising 0.6% in March. Compared to the year prior, the full index increased 4.2%, making it the largest 12-month increase since September 2008.

What is causing inflation?

The recent inflation concerns stem from current government stimulus policies intended at providing financial relief to those affected by the COVID-19 pandemic.

One of those relief measures involves the US government giving out enormous amounts of money during times of high unemployment. We’ve already seen almost $6 trillion worth of stimulus packages thrown into the economy during a period of low productivity. This could be a recipe for inflation.

So far, the US government has spent $867 Billion on stimulus checks. With three stimulus checks in bank people’s bank account, Americans have a lot of money to spend.

And where do you think all this money goes?

Some people have used their money to invest in the stock market. It’s not surprising that the S&P500 is now up 81% since March 2020, when the first checks were deposited.

Some people spent the money on real estate and real estate deposits. Due to this and other reasons, real estate prices have also increased.

Others have used their checks on consumer goods such as food, gasoline, cars, and electronics.

Excess money is leading to increased spending, gradually increasing the demand for goods and services hence pushing up prices.

On the other hand, there aren’t enough goods being produced since the COVID-19 pandemic has shut down businesses. As per the law of supply and demand, the rise in the prices of goods is thus imminent, and so is inflation.

What the Federal Reserve is saying.

So now, we’ve seen the government throw trillions into the economy. But where did this money come from? From the Federal Reserve.

One of the Federal Reserve’s mandates is to ensure maximum employment. Since the pandemic has left about 6% of the US population jobless, the Federal Reserve’s printing machine is in full gear to finance the government’s stimulus policy.

Hundreds of billions worth of stimulus checks were sent out to people, trillions were given to struggling businesses, and more billions were spent on tax relief to both individuals and companies. More hundreds of billions were used to equip hospitals, fund vaccination programmes, and pay for other government needs.

And just like that, the Fed’s printing machine magically solved all problems? Not exactly.

While the Federal Reserve did what it had to do, it isn’t without consequences. Any sound economist will tell you that there are repercussions to printing money, the major one being inflation.

In 2020, when the Federal Reserve decided to start their monetary support, they intended to allow inflation to temporarily rise a little above the 2% target. They believed that such inflation would only be short-lived and promised not to stiffen their policies until their goal was reached.

Fast forward to today, and the Fed is under pressure to tighten money supply after CPI data came in showing that US consumer prices rose at their fastest pace since 2008.

The Federal Reserve continues to insist that they expect inflation to rise, but it should be transitory.

Jerome Powell, the head of the Federal Reserve, says that the Fed is still a long way from withdrawing its monetary support.

Janet Yellen, the US Treasury Secretary, reinforces the Fed’s sentiment saying that a more considerable risk than inflation is not affording enough help to workers heavily affected by the COVID-19 pandemic.

How to profit from Inflation

So now we have money printing, a lot of money in people’s pockets, a high demand for goods, a labor shortage, supply chain problems, and rising prices. We’re also seeing prominent investors voice their concerns and warning about the impending inflation problem.

Even though inflation is still at a manageable rate, there’s a high likelihood that it will continue to rise and eventually get out of hand.

We’re now faced with the question – how can we profit from inflation or at least protect our finances from the effects of inflation? We’ll look at several things you should and should not do to prepare for inflation.

1. Cash is not King during inflation.

Cash is the worst asset to hold during inflationary periods. It’s good to have some money saved in an emergency fund in case you lose your job or a big emergency event occurs, and you need cash fast. However, having large sums of money sitting around in a bank account – even if it’s a high-yield savings account (typically pays about 0.5% interest rate) – is not a good idea.

Inflation will eat away your money since every single dollar becomes worth less and less as inflation rises. In the event of a 2% inflation rate, a high-yield savings account that offers 0.5% interest just won’t cut it. You’ll still be losing 1.5% per year on every dollar.

2. Real-Estate

Real estate is an excellent asset to own during inflation for three reasons:

- Real estate is a leveraged asset, meaning that you have debt(mortgage) on the property. Instead of eating away your cash, inflation conveniently eats away your debt. You end up paying less and less for the loan on the house as inflation rises.

- Inflation raises the price of everything, including real estate. The price of your home will rise by the rate of inflation times the cost of the house.

- Rental income increases during inflation. This is because it becomes difficult to get a mortgage due to high mortgage rates. People, therefore, choose to continue renting.

With just this one asset class, there are multiple ways to profit from inflation. And if you invest wisely, you stand to make a lot of money from real estate.

While the upfront costs of owning a house can make real estate investing seem unrealistic and unaffordable, don’t dismiss this asset class just yet. There’s an easier way to get in: buy a REIT.

A REIT (Real Estate Investment Trust) is a company that pools money together from different people and invests it into real estate.

Examples of REITs include American Tower Corp, SBA Communications, and Digital Realty Trust. You can get into these at very low prices.

Read More:

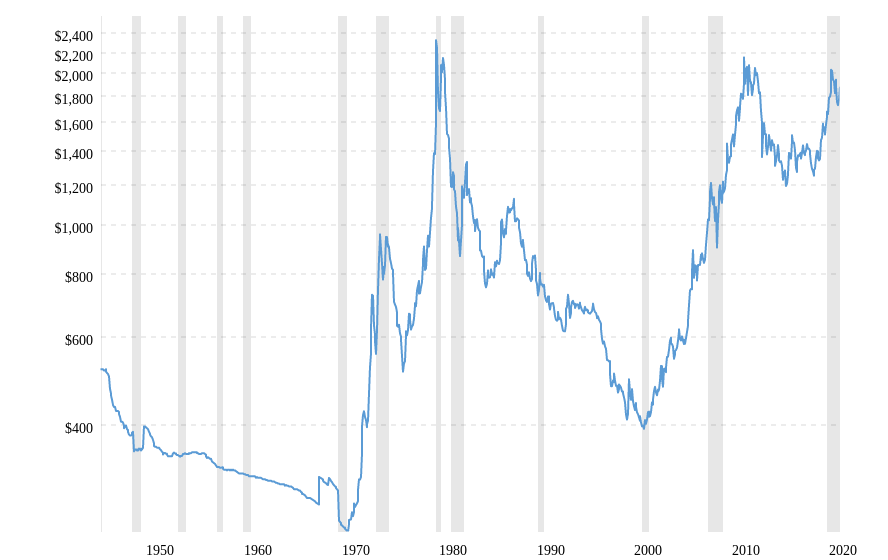

3. Gold

If real estate is not your cup of tea, another asset class to consider is gold.

Historically, gold has proven to be a good hedge against inflation. Many people have even gone as far as using it as an alternative currency, especially in countries whose currencies have significantly lost value.

You see, unlike fiat currencies (paper money), the supply of gold is limited, and its value cannot be watered down (e.g., by printing).

So when investors see the slightest signs of inflation, they flock to gold, and its price skyrockets. A quick look at history will show you this.

While, for many years, gold has offered a safe haven during inflationary times, it’s not guaranteed that it will continue to do so. Make sure you buy it when the price is still low.

4. Stocks

Not all stocks perform well during high inflationary environments.

During inflationary periods, you need to pick companies with the following characteristics:

- Able to generate cash and have high amounts of cash flow.

- Have high margins, meaning that their bottom line profits are very high compared to the amount they spend on producing their products.

- Companies that have control on pricing and can easily increase prices as inflation rises.

A good example is Apple, whose margin will not be reduced by the rising of commodity prices. Apple can also easily increase the prices of their products, and people will still be willing to buy them. The same goes for Microsoft.

During inflation, the large-cap companies with high amounts of cash flow and profits tend to do well compared to the small-cap, high-growth companies that are not very profitable and do not have much cash flow.

For example, the S&P500 – which is largely made up of highly profitable companies like the big tech companies – is up 13.5% year-to-date compared to the high-growth, low-profit companies like those in ARK Innovation ETF, which is down 6.06% year-to-date. It consists of rapidly growing companies that are not really profitable and do not have sufficient cash flow.

I’m not suggesting that growth stocks are not good. On the contrary, I think inflationary periods offer an excellent opportunity to open positions in good growth stocks while they’re cheap. Be warned, though; they may perform poorly for the entirety of the inflation period.

- Read More: 5 Things to do when the stock market crashes

Cryptocurrencies (Honorable mention)

As fears of inflation continue to rise, people are contemplating the efficacy of cryptocurrencies, precisely bitcoin, as ‘digital gold’ and therefore a hedge against inflation.

At the same time, others are against it because it has only been around for about a decade and that there’s not enough evidence to prove its effectiveness as an inflation hedge.

There’s a case to be argued for cryptocurrencies, though. With the dollar losing its value every day, people are looking to other forms of currency like bitcoin, whose supply is limited. Bitcoin’s total amount is set at $21 million and thus cannot be watered down.

In Conclusion

Inflation, which has not been around for decades, is threatening to make a post-pandemic comeback.

Inflation has the potential to nibble away at your lockdown savings.

Even if your savings are in a high-yield savings account, if inflation outpaces the interest you earn, you’ll be playing a losing game.

Don’t let that happen.

The following investments will help protect your money from inflation:

- Real estate

- Gold

- Stocks (cash-generating)

- Cryptocurrencies (risky and no proven history)

In addition to hedging against inflation, the above investments could even help you profit from inflation.

- Read More: The State of the Economy 2021

Disclaimer: None of this is meant to be construed as financial advice, it’s for entertainment purposes only. Links may include affiliate referrals and I may receive compensation from partnering websites. The content is accurate as of the posting date but may not be accurate in the future.