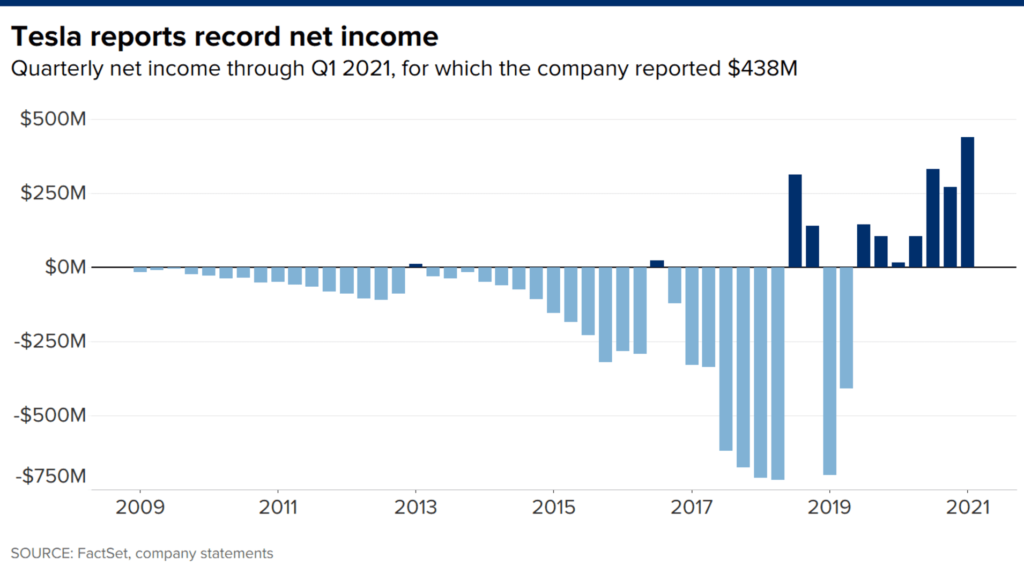

Tesla Q1 2021 earnings report was released on Monday, 26th April. Despite many challenges – including the ongoing chip shortage – the automaker was profitable for the seventh quarter in a row. Here’s a summary of Tesla’s Q1 earnings report.

In This Article

Revenues

The company reported a revenue of $10.39 billion compared to an analyst consensus of $10.29 billion. This revenue represents an increase of 75% from Q1 last year.

Tesla’s automotive sales came in at $9 billion, including $518 million of regulatory credits sales.

While energy sales were up 69% year over year to $494 million, they represented a drop of 34% quarter over quarter.

The sales of services contributed $893 million to Tesla’s revenue, a 59% increase for the same period last year.

Profitability

The automotive profit came in at $2.39 billion, a gross margin of 26.5%. However, 4.5% of this was driven by regulatory credit income. Excluding the regulatory credit income puts the automotive gross margin at a pleasant 22%.

Losses realized in energy sales and Tesla services contributed resulted in a drag of $170 million to the company’s total gross profit of $2.215 billion.

Earnings and EPS

The company exceeded the $1 billion earnings mark for the first time with a reported non-GAAP net income of $1.052 billion. This is an increase of 363% compared to a net income of $227 million in Q1 2020.

On a GAAP basis, the company’s net income was $438 million, an outstanding result compared to $16 million realized in Q1 last year.

Tesla reported an EPS(Earnings per share) of $0.93, representing a 304% increase year over year.

The most exciting item on Tesla’s balance sheet for me was the $293 million in free cash flow compared to -$895 million in the same quarter last year.

Why Tesla stock fell despite beating expectations

Even though Tesla’s earnings beat Wall Street’s expectations, investors didn’t seem satisfied, and the stock fell about 2%. Here are some of the reasons why:

Tesla’s profitability is still in question due to its heavy reliance on regulatory credit sales. Admittedly, at $518 million, credit sales appear to form a significant portion of the bottom line. Investors argue that with more legacy automakers making giant leaps towards manufacturing their own EVs, revenue from credit sales will no longer be sustainable.

Adding to investor jitters was yet another controversial item: the sale of Bitcoin. Tesla sold 10% of its bitcoin in Q1 for a net gain of $101 million. Like with credit sales, investors were not pleased about the sale of bitcoin contributing to the bottom line.

Investors are having a hard time justifying Tesla’s high valuations. Such earnings, heavily backed by unsustainable sources of income, are not making matters any better. That’s likely why we’ve seen a sell-off in the stock since the release of Q1 earnings.

What Wall Street doesn’t understand

- Tesla reported record deliveries of 184,800 vehicles in the first quarter. The deliveries only included Model 3 and Model Y vehicles. The company did not manufacture any Model S or Model X due to an ongoing model refresh. That being so, the revenue realized in Q1 did not include the sale of Tesla’s high-margin vehicles. In the Earnings call, Elon Musk said that they expect to resume Model S/X deliveries in Q2 and volume production in Q3. Once Tesla does this, we should expect to see a rise in the average selling price of Tesla vehicles, increased revenue, and probably a higher automotive gross margin.

- All Tesla vehicles are produced in two factories: Fremont and Shanghai. A large part of Tesla’s expenditure can be attributed to the construction of the two new gigafactories in Berlin and Texas and the expansion of Giga Shanghai. Once these projects are completed, production numbers will go up, and the delivery of new models such as the Cyber Truck will commence. Additionally, capital expenditures will ultimately reduce. In other words, the unsustainable revenue sources investors are currently worried about will no longer be a concern.

- CEO stock-based compensation amounted to $299 million in the first quarter. Such compensation is a non-recurring expense. If you were to exclude it from the Q1 earnings, Tesla would have made a profit even without the credit sales.

Is it too late to buy Tesla stock?

The stock sell-off happening is simply a result of anxiety.

Such great results as seen in Q1 can only be a disappointment to short-term investors.

As mentioned earlier, Tesla has excellent opportunities ahead that most investors on Wall Street do not seem to understand.

With the rapid electrification of vehicles and the sizeable EV market, the revenue opportunity for Tesla is enormous. Tesla’s expansion plans indicate that the company is preparing to gain the largest market share in the EV space.

In my opinion, it is not yet too late, but it will be very soon.

Disclaimer: None of this is meant to be construed as financial advice, it’s for entertainment purposes only. Links may include affiliate referrals and I may receive compensation from partnering websites. The content is accurate as of the posting date but may not be accurate in the future.