The story of 2020 seems to have been Tesla, and the narrative could very well extend into 2021. The biggest news this year has been Tesla getting into Bitcoin. Having already made a profit of roughly $1 billion, Tesla is geared up to make more gains from their bitcoin investments than from electric vehicle sales in 2021.

The expectation for Tesla is that it will be one of the largest – if not the largest – companies in the coming years. Yet still, a lot of investors are squirmish about the EV stock. So, is Tesla a buy right now? What are the concerns that some investors seem to have about Tesla? Should you buy Tesla stock before it’s too late?

In This Article

Concerns about buying TSLA

1. Recent declines

Many growth stocks have been taking a hit since mid-February. This includes Tesla, whose lowest dip reached $519, a decline of 36% from its recent highs. The market correction is primarily driven by negative investor sentiment about tech stocks’ rich valuations after a massive rally upwards in 2020.

At the time of this writing, Tesla’s stock price is $619. Many investors are looking for an opportunity to buy Tesla but wonder whether the stock price will continue to tumble.

Long-term investors are never worried about volatility, corrections, or market crashes. If anything, they see them as great buying opportunities.

The recent declines should only be a concern if you’re a short-term investor. Long-term investors are never worried about volatility, corrections, or market crashes. If anything, they see them as great buying opportunities.

Read More:

- Why the stock market is crashing.

- Why Bond Yields are rising. What it means for your portfolio.

- 5 Things to do when the stock market crashes.

2. Valuation concerns

Tesla does trade at a rich valuation. Even after the recent declines, the stock is still up 640% since the beginning of 2020. A market cap of $600 billion and a PE ratio of 966 makes it appear highly overvalued. One could argue that a lot of Tesla’s growth is already priced in.

However, looking into 2021, the stock is trading at 135x forward earnings. 135 P/E might look expensive, but remember Amazon traded at extremely high valuations during its growth years, at one point getting to as high as 3633 P/E. Amazon currently trades at 75 P/E.

Furthermore, Tesla has a lot of growth ahead and could outgrow this valuation if their expansion ambitions pan out as planned.

Forget the expensive trailing P/E ratio of 966, Tesla is currently trading at 135x its 2021 projected earnings.

3. Growing competition

The list of Tesla’s competitors is growing. VW recently announced its plan to build six gigafactories for battery production. The legacy auto manufacturer plans to produce over 70 EV models by 2028 and manufacture 22 million EVs over the next decade.

Other competitors include BMW, Audi, Mercedes Benz, Porsche, and Jaguar in Europe, not to mention Ford and GM in the US market.

New players in the EV space, such as Nio and XPeng, also offer stiff competition for the all-important EV market in China.

However, Tesla has a huge head start over its competitors especially in autonomous driving technology.

Volkswagen admitted that Tesla has a 10 year head start.

Reasons to buy TSLA.

Tesla is currently selling at a 20% discount from its recent highs. Here are some reasons why you should buy Tesla stock before it’s too late.

1. TAM (Total Addressable Market)

Total Addressable Market refers to the total revenue opportunity for a product. It provides a picture of how much money a company could possibly make considering the size of the market and current competition.

The electric vehicle market is a sizable one. In 2019, the global sales of automobiles stood at about 88 million units, and the electrification of vehicles is taking place at a rapid pace. According to Statista, the global size of the EV market is expected to reach $803 billion by 2027.

Considering the competitive edge that Tesla possesses, gaining a conservative 25%-30% market share is within reach. This is one of the biggest reasons why you should buy Tesla before it’s too late.

2. Recent earnings

2020 was an exceptional year for Tesla. Despite several years of net losses followed by an unexpected global pandemic, Tesla made a profit in each quarter of 2020.

They posted their first full-year profit of $721 million compared to a loss of $862 million in 2019. The company’s profitability and cash generation grew significantly due to increased sales volumes.

Their revenue rose to $31.5 billion in 2020 from $24.6 billion in 2019, an increase of 28%.

3. Anticipated deliveries growth

The management at Tesla plans to grow their manufacturing capacity so as to achieve annual growth of 50% in vehicle deliveries over a multi-year horizon. If these plans materialize, Tesla could deliver more than 3.5 million cars in 2025. Elon Musk’s vision is to ultimately achieve a production capacity of 20 million EVs a year – double the production of other legacy automakers.

Although remarkably optimistic, Tesla’s delivery growth projections are achievable since they have embarked on constructing gigantic manufacturing plants in Berlin, Germany, and Austin, Texas. According to InsideEVs, the Berlin gigafactory may eventually produce up to 2 million EVs a year.

4. Revenue growth

If Tesla grows its delivery numbers as planned, revenues stand to rise from the current $31 billion in 2020 to over $130 billion in 2025 and possibly over $1.3 trillion in 2035.

5. Net Income growth

Due to increased automation, declining battery costs, and increased autonomous driving software sales, Tesla’s net margins could grow to about 21% by 2025.

Substantial revenue growth accompanied by such high margins could result in a net income of about $35 billion in 2025 and up to $280 billion in 2035.

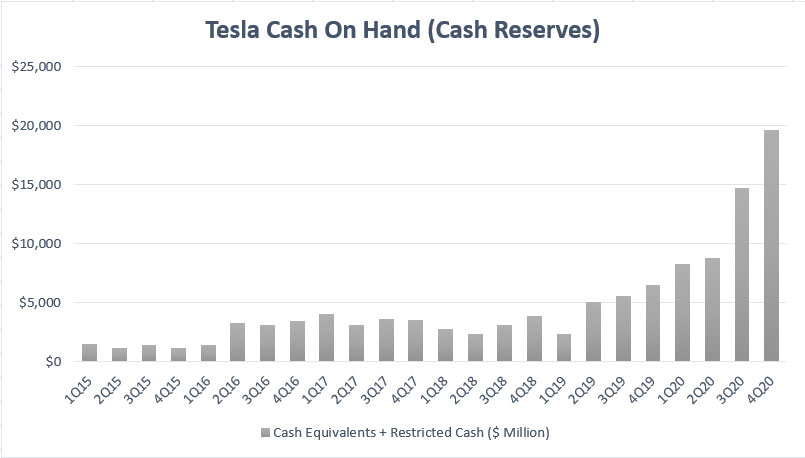

6. Healthy cash position

Cash is simply the lifeblood of a business. And for Tesla, sufficient cash flow is the most important financial metric due to the capital-intensive nature of the automotive industry.

The high-expense and high-cost business environment have always put investors on edge, worrying that Tesla could go bankrupt.

Favorably, Tesla grew its free cash flow to $2.9 billion and its cash and cash equivalents to $19.4 billion in 2020.

With these amounts of cash, Tesla can meet its expense obligations and fund its vast expansion plans, including building more gigafactories.

More Reasons To Buy Tesla Stock

- Tesla is also in the business of software, and it’s huge

- Tesla is far ahead in self-driving technology

- A vast system of super-chargers.

- Energy storage business

- Insurance business

Conclusion

So, should you buy Tesla stock before it’s too late?

From what we’ve seen so far, professional investors don’t like Tesla. But they didn’t like Amazon either and look at how that played out for them.

There are more than enough reasons to decide whether to buy TSLA. For me, it’s a buy below $700.

With Tesla, just like with many other stocks, patience is vital. In the short-term, price volatility will be scary. However, if you stay in it for the long haul, patience will be greatly rewarded.

With Tesla, just like with many other stocks, patience is vital. In the short-term, price volatility will be scary. However, if you stay in it for the long haul, patience will be greatly rewarded.

Disclaimer: Our content is intended to be used for information and education purposes only. It is therefore important to do your own analysis before making any investment decision. We highly recommend that you seek independent financial advice from a professional, or independently research and verify, any information you find on our website and wish to rely upon, whether for the purpose of making an investment decision or otherwise.