When interest rates are rising, many things can go wrong. A rate hike can quickly turn into a financial disaster if you’re not prepared. For example, your credit card or mortgage payments can get out of hand, putting your financial health at risk. But with a little bit of knowledge and some careful planning, you can weather the storm and keep your finances in good shape. So what mistakes should you avoid when interest rates rise?

- Related:

- What Happens When Interest Rates Rise?

- Stocks That Do Well When Interest Rates Rise

- Could Sanctions on Russia Affect You?

In This Article

- 1. Having an adjustable-rate mortgage on your home

- 2. Carrying a balance on your credit card

- 3. Margin debt

- 4. Relying too heavily on fixed income from investments like bonds

- 5. Having monthly payments that exceed 40% of your income

- 6. Buying or leasing a car right now

- Tips for keeping your finances in good shape during times of high-interest rates

1. Having an adjustable-rate mortgage on your home

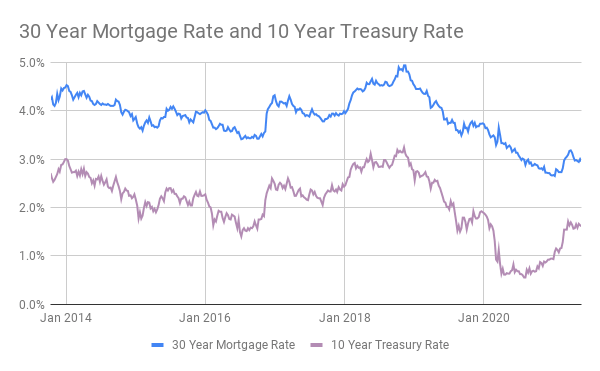

When the Federal Reserve raises the Fed Funds rate, the 10 Year Treasury yield also rises. And this immediately drives up mortgage rates.

Since December 2021, when news came out that the Fed would start raising interest rates this year, the 10 Year Treasury yield has risen from 1.40% to 2.29%(at the time of this writing).

Now that we expect the Fed to raise rates about six more times this year(and even more times next year), there’s a risk that the 10-year yield will keep rising to levels that could make it difficult for people with adjustable-rate mortgages to make their monthly payments.

Of course, you have nothing to worry about if you have a fixed-rate mortgage.

However, if you have an ARM (Adjustable-rate mortgage) or a HELOC (home equity line of credit), then it’s advisable to seek refinancing so you can have a reliable fixed mortgage payment each month. This way, you won’t have to worry about your mortgage payments rising due to interest rate hikes.

2. Carrying a balance on your credit card

Credit card debt is probably the worst type of debt you can have in a rising rates environment. That’s because analysts project that for every 0.25% rate hike by the Fed, we might see credit card interest rates rise by about 1%.

And so, taking into account the seven rate hikes expected this year, we could see credit card rates rise from the current average of 16% all the way to 24%.

So if you have any credit card debt, it should be the first thing you pay off before rates rise any further.

3. Margin debt

This is yet another horrible debt trap to find yourself in because there are two risks associated with it. First is the risk of paying higher interest for your margin debt, and second is the risk of losing all your investments if the stock market continues to decline.

Margin debt is a loan given by brokerage firms to investors to buy stocks, options, or other securities.

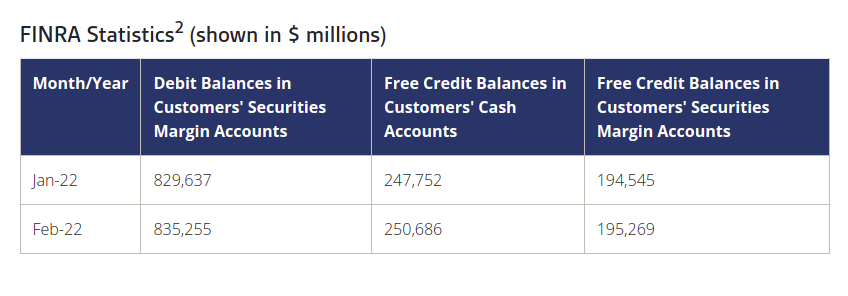

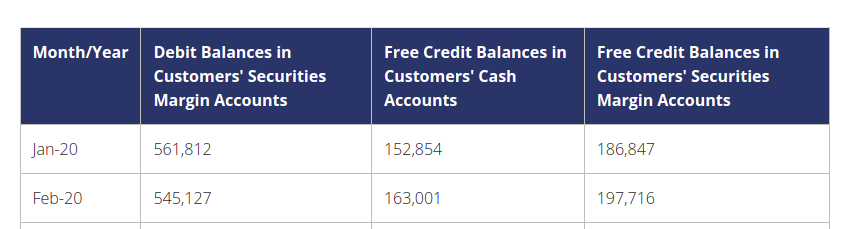

Margin interest rates have been as low as 2% in the past few years, incentivizing investors to borrow money to finance their investments. Unfortunately, taking out margin has been so prevalent that the U.S is at some of the highest levels of margin debt since before the pandemic.

As interest rates start to rise, margin interest rates will also rise, and the cost of maintaining such high margin levels will dramatically increase.

So if you have any margin debt and you hold stocks that could go down, consider getting out of margin as soon as possible.

4. Relying too heavily on fixed income from investments like bonds

If you rely on fixed income such as bond coupon payments, what happens is that your 1.5% yield suddenly becomes less valuable compared to the high yields currently on the market.

When interest rates rise, these two things will happen to your bonds:

- First, their value will go down considerably, and you could end up losing a lot of money on your investments.

- Bond yields will rise, so any new bonds coming into the market will have better yields than your bonds.

High-yield bonds and other investments utterly suffer when rates rise, and investors often prefer to sell them off, further decreasing their values. So don’t rely too heavily on bonds for income.

5. Having monthly payments that exceed 40% of your income

It’s essential to keep an eye on your monthly payments to stay out of financial trouble when interest rates go up.

Make sure that they don’t exceed 40% of your income. In addition, avoid taking on new loans and be careful about your budget. This way, you can be sure that you’re able to afford your monthly payments, even if interest rates rise.

6. Buying or leasing a car right now

It’s impossible to look at vehicle prices right now and not feel like it’s a scam. When used cars start selling at higher prices than their new counterparts, it’s a sign that the market has gone berserk.

So when you factor in the rising interest rates, it becomes the worst possible time to purchase a car.

If you think you’ll need a car over the next two years or so, I suggest buying it right now before interest rates rise any further. That’s because we might see rate increases well into 2023.

However, if you can wait a couple of years for supply chain issues to ease off, vehicle prices could go down, and possibly interest rates too, making purchasing a vehicle much cheaper.

Tips for keeping your finances in good shape during times of high-interest rates

1. Avoid taking out new loans.

Debt is one of the biggest dangers when interest rates rise. When it becomes more expensive to borrow money, people can quickly get over their heads. If you’re struggling to make ends meet, taking on more debt is only going to make things worse.

2. Shop around for best deals if you must borrow

If you must borrow, only borrow what you need, and shop around for the best deals possible. This way, you can avoid paying more in interest than you have to. By being smart about your borrowing, you can keep your finances in good shape even when interest rates go up.

3. Pay off credit cards in full every month

If you only make minimum payments on your credit card debt, the slightest increase in interest rates could significantly raise your credit card debt and make it more challenging to pay your monthly payments.

So start making more than just the minimum payments or consider paying off all your credit card debt by cutting down your spending, budgeting or using any saved up money.