The Russian invasion of Ukraine has triggered a massive outcry from all over the world, initiating perhaps the strongest sanctions ever imposed against a major global power since the Second World war.

Even though the sanctions are intended to hurt Russia, they may have unintended repercussions that could affect you and me. For example, the US economy is likely to slow down, and Europe is at the risk of a recession.

- Related:

- Russia-Ukraine Conflict: How War Affects The Stock Market

- Russia-Ukraine Crisis: What it Means for Inflation, Rate Hikes and The Stock Market

- Stock Market Crash: Your 4 Big Questions Answered

In This Article

What sanctions have been imposed on Russia?

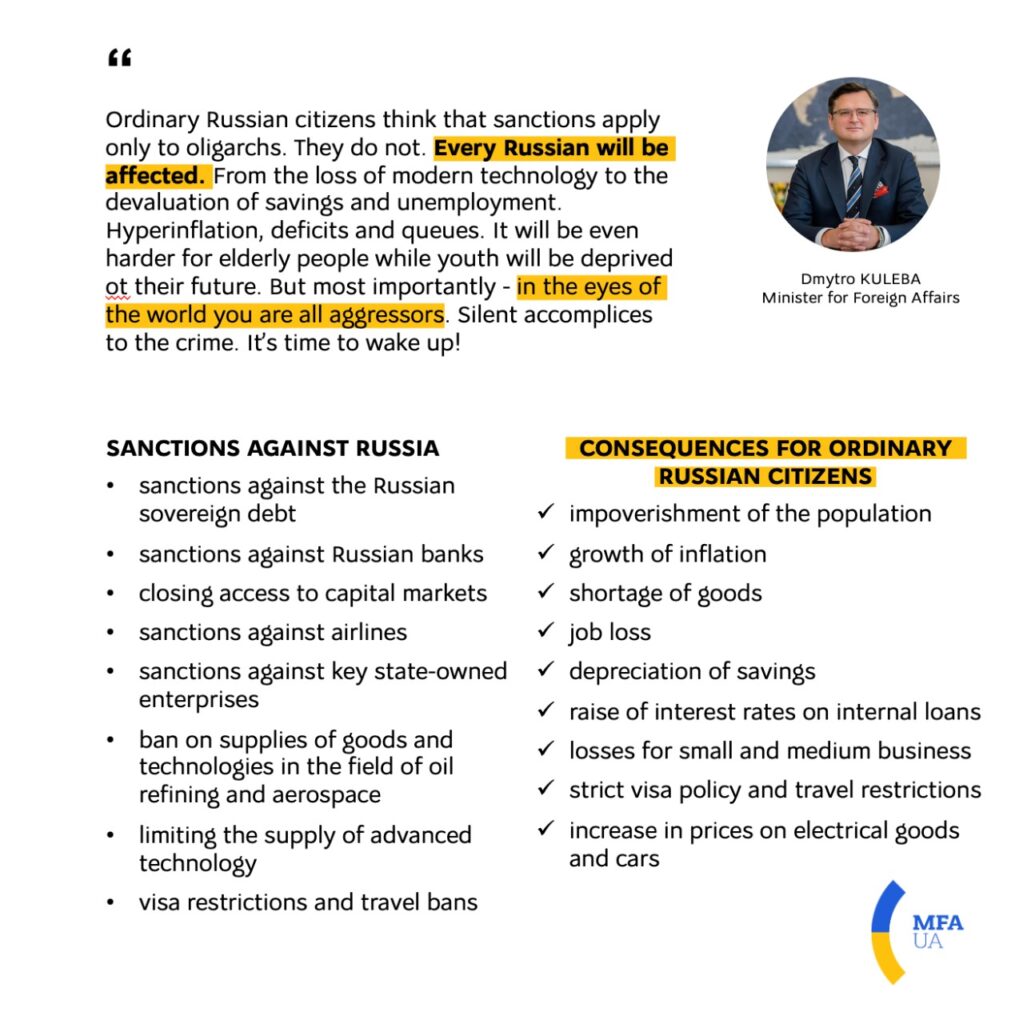

Immediately Russia invaded Ukraine, western countries, including the U.S, UK, EU, and Canada, quickly agreed to wage an economic war on Russia.

Swift: The first action was to exclude Russian banks from Swift. Swift stands for Worldwide Interbank Financial Telecommunication. It’sIt’s a financial transaction system that allows banks to send money and communicate internationally. Cutting Russian banks off of Swift stops them from conducting transactions globally, meaning that they can’t buy or sell anything internationally. Now, this not only affects Russian imports but also affects all other countries that import goods from Russia. A good example is countries like Yemen and Lebanon, which import Russian wheat and are now at the risk of experiencing food shortages and price hikes.

Freezing of Foreign exchange Reserves: The US froze $630 billion in assets held by the Russian Central Bank in other international banks around the world. As a result, the West has effectively prevented the country from using this pile of international reserves to buy their own currency to save the Ruble from a crash. The effect? The Ruble is on a free fall. Meanwhile, freezing these assets prevents Putin from being able to finance the attack on Ukraine.

No more borrowing: Russian banks and companies can no longer borrow money from Western markets.

Individual oligarchs targeted: President Vladimir Putin and Foreign Minister Sergey Lavrov are among the Russian individuals and oligarchs who have been targeted with personal sanctions. Any assets in Western countries belonging to these elites have been frozen, and the individuals are now banned from doing business there.

Until a few days ago, Russian oil and gas had been spared from the sanctions. However, things changed when Biden announced that the US would put an embargo on all oil imports from Russia. The EU, on the other hand, committed to phasing out Russian gas imports by the end of this year.

Why have sanctions been imposed on Russia?

Sanctions on Russia’s top banks are aimed at breaking the country’s ties to the international financial system and preventing it from raising capital to fund its war in Ukraine. The Russian banks will also be unable to undertake the majority of their financial activities, putting a stop to Russian exports and imports.

Western governments hope that by inflicting economic hardship on Russia, Putin will change his mind.

How sanctions have affected Russia’s economy

While the sanctions will take some time to affect the Russian economy fully, it’s already clear that they will have devastating effects in the coming months.

The Ruble, the Russian currency, is already in rubble, having fallen about 30% against the US dollar. This has made it difficult for Russians to afford basic necessities like food and clothing.

Retail stores and supermarkets are almost empty as people have rushed to stock up on supplies. To make matters worse, it’s no longer possible for these retail stores to import goods as they cannot pay for them through the Swift system.

In a desperate effort to save the currency, the Russian Central bank has raised interest rates to a whopping 20%. The bank is now bracing for hyperinflation, a sharp decline in economic growth, and widespread unemployment.

How sanctions on Russia will affect the global economy

1. Food shortages

One of the most worrying implications of sanctions against Russia is the possibility of food shortages. The country is a major food producer and exporter. Together with Ukraine, the two countries account for about 30% of global wheat exports, nearly a fifth of global corn exports, and almost 80% of global sunflower oil exports.

Since sanctions prevent Russia from selling its food abroad, countries that rely on Russian wheat are at the risk of facing food shortages. Furthermore, the escalation in the Russia-Ukraine conflict is disrupting the supply of wheat and could lead to food shortages very soon.

The situation is particularly concerning for countries like Lebanon, Yemen, and Libya, which are already struggling with food insecurity yet heavily rely on Russian wheat to meet their food demands.

2. Higher gas and energy prices

Gas prices are already on the rise in all Western countries, and they are expected to go even higher in the coming weeks. This is because the US has imposed an oil embargo on Russia, which prohibits American companies from doing business with Russian oil and gas companies, thus limiting Russia’sRussia’s oil exports.

A lack of Russian oil on the market will result in a global oil shortage, driving up the price of oil and, consequently, the price of gas. This means that everyone will have to pay more at the gas pump.

In addition to sanctions, oil and gas supplies are also at risk of being withheld by Russia as retaliation for the severe sanctions. Russia is threatening to turn off gas pipelines to Europe if the stream of sanctions on Russia continues.

This has many people anxious in Europe, which imports more than a third of its gas and a quarter of its oil from Russia. Any disruption in gas supplies could leave Europeans without enough gas to heat their homes and face astronomical energy bills as utilities scramble to find fuel to create electricity.

- Read More:

- How To Protect Your 401(k) From A Market Crash in 2022

- When Should You Sell A Stock?

- What Should You Do In This Stock Market Crash?

3. Disruption in global supply chains

Global supply chains that had not yet recovered from the chaos of the pandemic have now been sent into further disarray by the Russia-Ukraine conflict. This has resulted in higher costs, longer delivery times, and other obstacles for businesses trying to move goods around the world.

Since the beginning of the conflict, thousands of flights have been canceled or rerouted while shipping companies like Maersk and CMA CGM have suspended all cargo bookings to and from Russia. All this puts a strain on freight capacity and threatens to disrupt supply chains further.

Automakers are already feeling the pain, with Volkswagen announcing that it will be limiting production at its major factory in Wolfsburg and several other German factories due to component shortages. BMW has also said they’ll cut output across manufacturing locations within Germany as well as Austria and UK. This is not good news for an industry that was expecting record sales this year.

The situation gets worse for automakers as many of the materials needed for automotive manufacturing are now in short supply. Ukraine and Russia are major suppliers of palladium and platinum, as well as aluminum, steel, and chromium, which are used in catalytic converters.

Platinum, aluminum, steel, and chromium are even more commodities whose supplies are coming under pressure over the Russia-Ukraine conflict and gravely affect the automobile industry.

Manufacturers of semiconductors are keeping a close tab on worldwide supplies of neon, xenon, and palladium, which are required to make their goods.

Sunflower oil, primarily produced in Russia and Ukraine, could be in limited supply for potato chip and cosmetic manufacturers.

Global supply chains are the lifeblood of many industries, but they’re increasingly coming under attack. This can have severe consequences for businesses across various sectors – including increased costs that lead to higher prices on products you buy every day.

4. A rise in the price of goods and services

The increase in gas prices affects not only consumers but also businesses. Since most companies require energy to run their manufacturing operations and transport materials and finished products, their input costs increase significantly when gas prices rise.

When these business input costs go up, businesses are forced to pass the extra costs onto consumers, resulting in an increase in the price of goods and services.

5. Higher Inflation and the risk of hyperinflation

The effects of Russian sanctions mentioned above – such as food shortages, higher energy prices, supply chain disruptions, and a rise in the prices of everyday goods and services – all lead to one thing: inflation.

The economic impact of the Ukrainian conflict and sanctions will be felt by the majority of people around the world in the form of rising inflation, primarily due to higher energy, metal, and food costs.

The prices of commodities exported from Russia, such as wheat, sunflower oil, aluminum, palladium, nickel, oil, and natural gas, are at all-time highs.

Inflation was already a problem way before the Russia-Ukraine conflict, as it was at its highest level since the 1980s in the United States. Now everyone is worried about whether the conflict could cause hyperinflation — and how the Federal Reserve and other central banks will react.

Conclusion

In conclusion, it’s clear that sanctions against Russia could have far-reaching implications for the global economy. They could lead to food shortages, potentially higher gas and energy prices, an economic downturn, and even higher inflation.

There’s one piece of good news, though. Because of the uncertainties surrounding the economy’s recovery, central banks’ intentions to boost interest rates may be delayed, which means ultralow mortgages and personal loans may be available for a bit longer.