The geopolitical crisis in Eastern Europe has taken a dark turn, and there’s now an armed conflict between Russia and Ukraine. The conflict not only endangers the lives of many innocent people but also has the potential to plunge the rest of the world into an economic crisis.

I’m sure many of you are wondering how all of this will affect your portfolios. And so, in this article, we’ll look at how geopolitical conflicts affect the stock market, both in the short term and in the long term. Hopefully, it will help us understand what’s currently happening so that we can continue staying the course.

- Related:

- How To Protect Your 401(k) From A Market Crash in 2022

- When Should You Sell A Stock?

- What Should You Do In This Stock Market Crash?

In This Article

How does conflict affect Markets in the short term?

The very first thing that gets affected during times of conflict is commodity prices, which are things like oil, gold, aluminum, palladium, and titanium.

Oil

With the conflict between Russia and Ukraine, the biggest consequence will be the rise in oil prices. Russia is the world’s third-largest oil producer, and supplies about 40% of EU’s natural gas imports.

Heavy sanctions against Russia have been enforced, and while they’re intended to inflict maximum pain on Russia, they’ll inevitably affect the rest of the world.

At the time of this writing, Crude oil is up 8%, and Brent has surpassed the $100 mark. Unfortunately, that means gas prices will go up, and the cost of living will also rise, and this will affect us all.

Gold

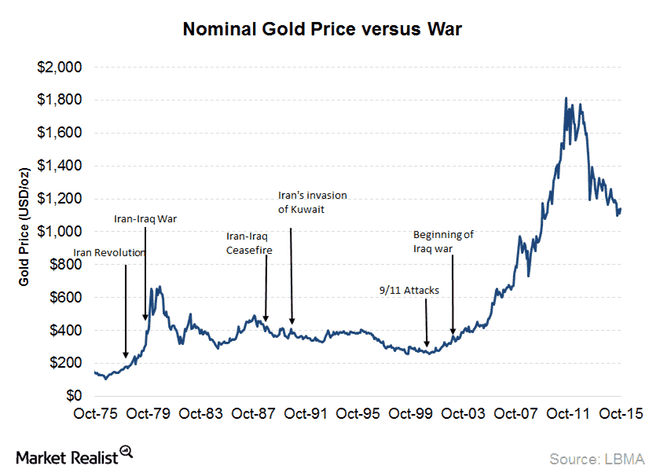

Gold is the second commodity that significantly benefits from a geopolitical conflict. A good example is in the late 1970s when we saw conflicts like:

- The Iranian Revolution,

- The invasion of Afghanistan by the Soviets,

- Iran-Iraq conflict.

Gold prices rose by 23% in 1977, 37% in 1978, and an astonishing 126% in 1979.

The reason why gold prices rise during conflict is this: geopolitical conflicts lead to massive government spending, which means that a lot of money is printed, causing widespread inflation fears.

As things unfold in the Russia-Ukraine conflict, the US will have to keep supporting Ukraine, which will cost a lot of money, especially if the conflict lasts too long.

Such government spending could raise fears of inflation, and investors could start putting their money in inflation hedging assets like gold.

We already saw investors start to panic on Wednesday when gold drastically rose 3.17%, the highest it’s traded in over a year.

Tech stocks and crypto

The next thing that gets adversely affected by conflict is tech stocks.

On Wednesday, we saw the Nasdaq fall more than 3%, which is astonishing when you compare it to the 1.5% fall by the Dow Jones on that same day.

Companies like Tesla, Nvidia, Redfin, and AMD were down more than 4% on Wednesday.

Stocks in the tech sector usually get absolutely decimated during times of conflict. And to understand why we need to look at the main reason why investors buy tech stocks in the first place.

Tech companies are able to innovate and grow rapidly because of their ability to borrow money cheaply. And this growth is what attracts a lot of investors into tech stocks.

However, during times of conflict, borrowing costs skyrocket, forcing tech companies to cut back on their borrowing, which slows down their growth.

But keep in mind that investors are only interested in tech stocks because of their growth. And so, when growth slows down, they sell out immediately, causing tech stocks to plummet.

Since the beginning of the year, the stock market has been highly risk-averse, which means investors have shied away from high-valuation and risky assets like tech companies. And as the Russia-Ukraine conflict continues, this pattern may worsen.

Cryptocurrencies might suffer the same fate as tech stocks due to their high-risk nature. For instance, shortly after news of the Russia-Ukraine conflict broke, Bitcoin dropped 8%, and Ethereum dropped 7%.

What will the market do in the long-term?

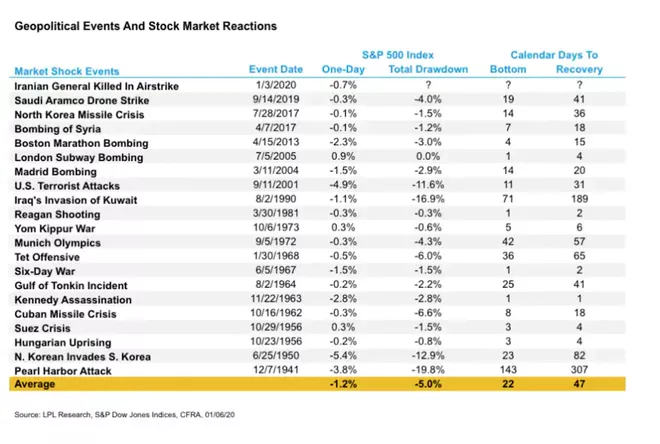

Research by LPL Financial showed that the market usually shrugs off geopolitical conflicts over the long term. This chart here shows that the S&P500 only lost an average of 5% during all these tragic events.

Even more surprising is that it only took an average of 47 days to recover from the downturns.

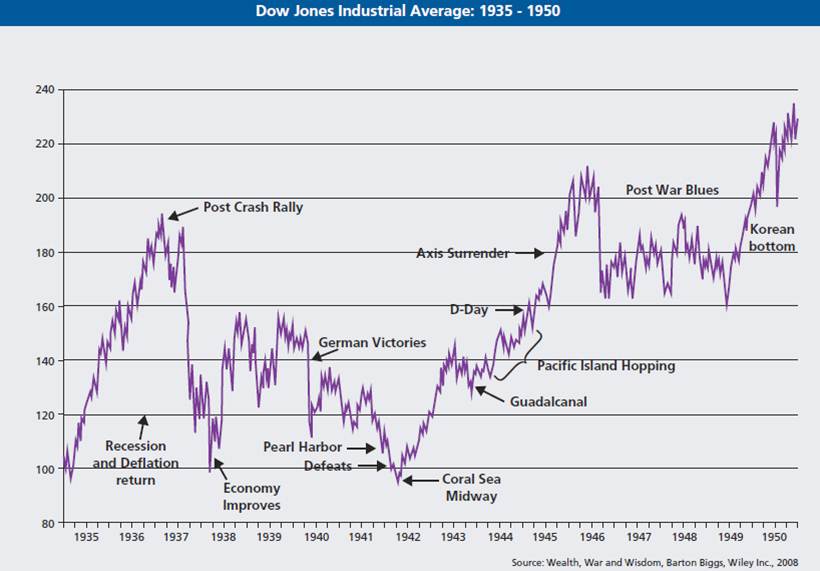

Another surprising statistic happened during the second world conflict between 1939 and 1945. During the entire conflict, the Dow gained a total of 50%, which equates to slightly more than 7% per year.

The war puzzle

In essence, this information tells us that the market is a very complex entity, and nobody can accurately predict its performance. But one thing we can all agree on is that the market doesn’t like uncertainty.

History shows that periods of uncertainty are when stocks suffer the most.

Researchers have also found that when signs of a crisis emerge, and the risk of a potential conflict is increasing, that’s when there’s peak uncertainty and stocks tend to decline rapidly.

Ironically though, as soon as the conflict begins, it seems to boost the price of stocks. This phenomenon is called the war puzzle. And there’s no vivid explanation as to why the start of a conflict raises stock prices.

Conclusion

Now, it’s worth noting that the Russia-Ukraine conflict is evolving, and things could take a completely different turn as soon as I put my pen down. So I am personally not making any hasty investment decisions at this time.