One of the most anticipated IPOs is finally happening. Coinbase, which has grown to become the largest cryptocurrency exchange, will be going public on April 14 using the ticker COIN. 2020 was an exceptional year for the cryptocurrency world, and this IPO couldn’t come at a better time. Here’s what you need to know about the Coinbase IPO.

Unlike traditional IPOs, where companies hire investment banks to help with the process, Coinbase plans to list its shares straight on the Nasdaq stock exchange using the direct listing technique. Although rare, the same approach has been used by prominent tech companies like Spotify and Palantir.

In This Article

Coinbase’s business: What does Coinbase do?

If you wanted to buy Bitcoin, you’d have two ways to go about it. One option would be to mine your Bitcoin, and the other would be to buy it on an exchange.

The first option involves solving complex math problems using powerful computers that are costly and consume a lot of energy. In contrast, the second option only requires you to create an account on an exchange. Unmistakably, most people will prefer buying to mining, and this is where Coinbase comes in handy.

Coinbase is a cryptocurrency exchange that makes it easy for you to buy, store, sell, and trade cryptocurrencies like Bitcoin, Ethereum, etc. It provides an online exchange where sellers and buyers can meet and find a consensus on prices.

Coinbase makes money by charging a commission fee on every transaction conducted on its platform. It also charges margin fees, also known as the spread, which is the difference in price between when you get an order quote and when your order is actually completed.

The Business Opportunity

While the internet has dramatically transformed most areas of society, the financial system remains cumbersome and inaccessible to many people in both the developed and the developing worlds.

Cryptocurrencies have now emerged to create an innovative financial system that’s more fair and transparent. Coinbase is at the forefront of providing access to this open financial system to the world. It does this by making it easy and secure for anyone to send and receive cryptocurrencies.

Coinbase Valuation

According to its IPO filing, Coinbase has listed 114,850,769 shares, but it’s not yet known how many will be available for trading. The company plans to reveal its proposed stock price a day before trading begins.

Details around Coinbase valuation remain unknown too. On the private markets, the company is valued at $68 billion. Analysts’ valuations fall between $70 billion and $100 billion.

Should you invest in Coinbase?

The Bullish outlook

1. Bitcoin’s mass adoption

Bitcoin and cryptocurrencies, in general, have become more widely accepted over the past few years. Institutional investors have been the latest to hop onto the bandwagon, making cryptocurrencies more mainstream. Tesla, for instance, now accepts Bitcoin as payment for their electric vehicles.

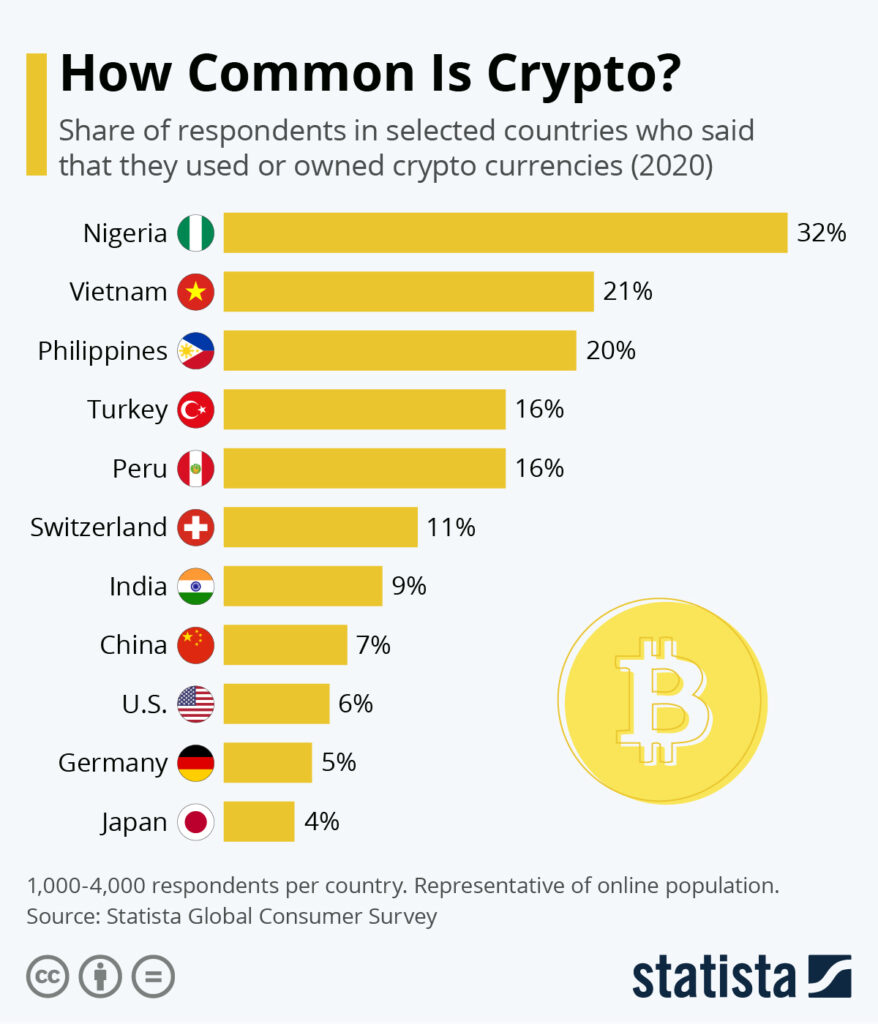

The use of cryptocurrencies is also on the rise globally because it has become a popular and cheap way to send money across borders. Although based in the US, Coinbase is available in over 100 countries. Most users all over the globe discover and begin their crypto ventures through Coinbase.

Related: Want to buy Bitcoin? Try Coinbase.

2. Compelling customer metrics

In its 2020 fiscal year report, Coinbase reported having 43 million verified users and 2.8 million monthly transacting users on its platform. The company holds assets worth $90 billion and has had a trading volume of $456 billion over its lifetime.

3. Coinbase Exceptional Revenues

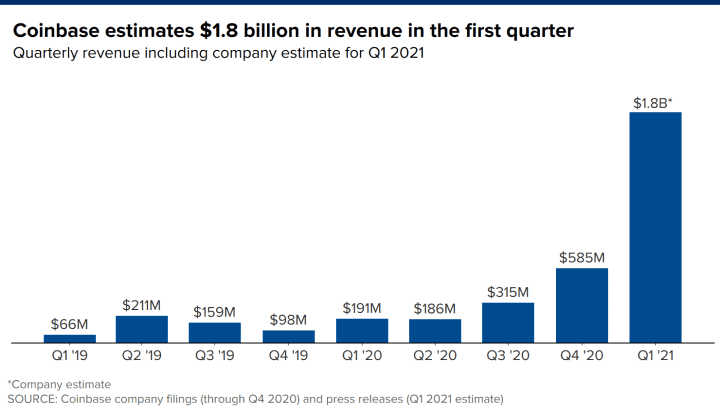

Coinbase reported revenue of $1.14 billion and a net income of $322 million for the fiscal year ended December 31, 2020. This represents a revenue increase of 139% year over year.

4. Accelerating growth

Coinbase has gone further to release staggering preliminary results for the first quarter of 2021. Revenue outperformed the entire year 2020, towering to $1.8 billion. Net income also surged and is expected to be between $730 million and $800 million.

Customer numbers have been equally impressive. Coinbase has grown its user base to 56 million from 43 million in the first quarter alone. Monthly transacting users have also increased from 2.8 million to 6.1 million in the last three alone.

These numbers are expected to continue growing as Bitcoin and cryptocurrencies become more accepted and integrated.

The Bearish Outlook

1. Volatile nature of cryptocurrencies.

Coinbase’s revenue is highly dependent on the prices of crypto assets and transaction volumes conducted on their platform. But due to high volatility in the crypto space, revenues are bound to have sharp fluctuations from quarter to quarter.

2. Changes in government regulation.

Even though Coinbase is a fully regulated and licensed crypto exchange, the company still faces risks from legislation that might curtail the use of cryptocurrencies. Some governments might still want to maintain control and dominance of their currency. India, for example, has made it mandatory for companies operating in the country to disclose all cryptocurrency dealings.

3. Hacking

There have been cases of high-profile hacks on crypto exchanges, for example, the Japanese exchange Mt.Gox, where crypto assets worth billions were lost, leading to bankruptcies. Coinbase says their platform is secure and that they’ve never been hacked. Hacking remains a significant threat, and the company has to stay vigilant.

4. Competition

Bitcoin’s popularity has created more competition for Coinbase. More crypto exchanges and wallets, e.g., Gemini, BlockFi, and Binance, are emerging as significant competitors. They offer lucrative incentives to their prospective customers, such as free crypto when they join and high interest rates for their stored assets. Additionally, high commission fees charged at Coinbase could force users to opt for no commission brokers like Voyager.

In Conclusion.

The Coinbase IPO is very tempting, without a doubt. It’s the largest crypto exchange, and its recent earnings have been mind-blowing. Unlike other start-up tech companies, Coinbase is a company that’s already making a lot of money in profits.

If you can handle the volatility and the other risks mentioned earlier, this could be an excellent opportunity to bet on the future of cryptocurrency.

Related: Should I buy Tesla stock before it’s too late?

Disclaimer: Our content is intended to be used for information and education purposes only. It is therefore important to do your own analysis before making any investment decision. We highly recommended that you seek independent financial advice from a professional, or independently research and verify, any information you find on our website and wish to rely upon, whether for the purpose of making an investment decision or otherwise.

One reply on “The Coinbase IPO: What You Need to Know.”

One of the very best electrifying companys around today is this small brassy URBT. It is really a stock to watch I think you must try it out. Their stock symbol is OTCMKTS: URBT Urban TV Network Corp is OTC:URBT makes a advance into the digital currency markets. The world woke up to the headline that the giant URBT now eyes creating its cryptocurrency exploration business. The enterprise commemorates as it has mined its first dollar. I believe that we will need to adjust our thoughts away from quick-term gain toward lengthy-term investment and durability, and have the next decades at heart with every assessment we make.