Robinhood, the controversial stock trading app and the pioneer of commission-free trading, is finally going public after months of speculation. The company plans to list on the Nasdaq under the ticker symbol ‘HOOD’ on July 29 at an initial price of $38.

It’s undeniable that Robinhood has revolutionized the investing space. The company has nailed the options trading feature and made it extremely easy and cheap for users to trade stocks, ETFs, and crypto. So it’s no wonder a lot of people flooded the platform during the pandemic.

As popular as Robinhood might seem, the company is equally controversial. The platform attracted a lot of hate from retail investors, like Wallstreetbets, when on January 28, it stopped users from buying Gamestop stocks and options. And while it’s unknown how much the saga affected user growth, it’s significant enough to make investors nervous going into the IPO.

Additionally, after the Coinbase IPO debacle, investors are anxiously looking to see how the Robinhood IPO pans out, mainly because both companies are in the fintech sector.

In this article, we’ll look at Robinhood’s business, financials, valuation, and other factors to consider when deciding if you should invest in Robinhood.

In This Article

Robinhood’s brief history

The story of Robinhood is a lot like the legend story of Robin Hood.

Just like Robin Hood, who rebelled against the heavy taxation of the poor, the founding of Robinhood was hugely inspired by Occupy Wall Street movement, which was a rebellion against the financial system after the 2008 financial crisis.

While being one of the greatest wealth creators, the stock market was full of entry barriers that disincentivized millions of people from participating.

Back then, if you wanted to invest in the stock market, you were charged a commission of $5 – $10 per trade. Worse still, brokerages required a minimum investment of $500 to open an account.

Vlad Tenev and Baiju Bhatt, two former Stanford students, watched as banks got bailed out and protests unravel. They realized that an entire generation of young people felt excluded from the capital markets.

And so, they decided to find a way to make the market accessible to all. They created a mobile app that allowed anyone to buy and sell stocks without paying any commissions.

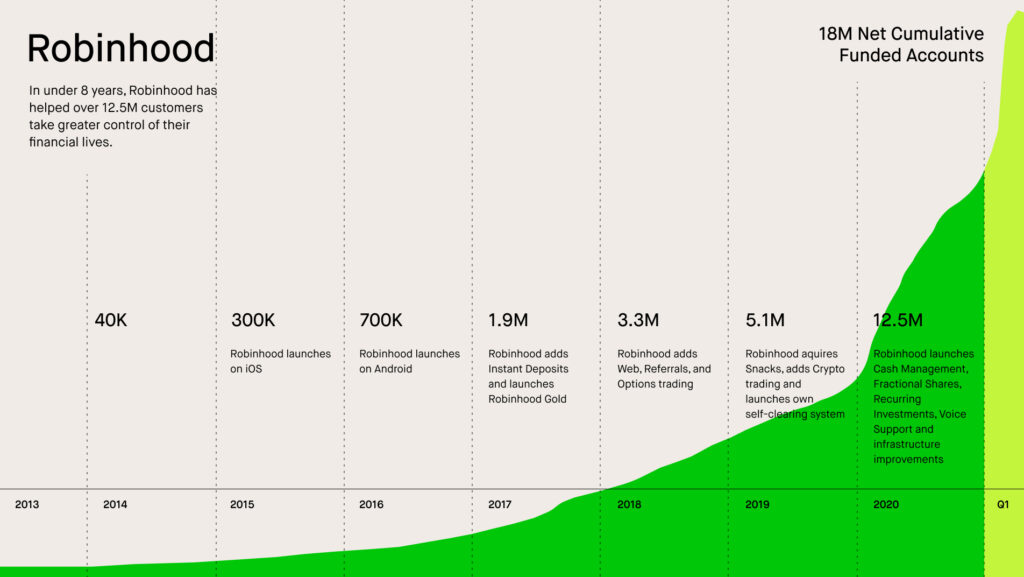

Since then, the platform has massively grown and now has 17 million monthly active users with $81 billion assets under custody.

| Net Cumulative Funded Accounts | 18M |

| Monthly Active Users | 17.7M |

| Assets Under Custody | $81B |

| Customers who are first-time investors | >50% |

| Organic or referred new customers | >80% |

Robinhood’s business and its business model

Robinhood’s mission is to democratize finance for all. Hence, their business model is built around the idea that everyone should have equal access to the financial markets.

They started working on this mission by creating a mobile app platform that offered commission-free trading and no account minimums. This affordable system, coupled with the ability to buy fractional shares, has made investing extremely easy and approachable.

Robinhood has thus attracted millions of novice investors, particularly millennials, to the platform.

What Robinhood offers

Even though Robinhood started as a US securities-focused trading platform, it has further developed and currently offers:

- US-listed securities and ETF trading

- Cryptocurrency trading with seven cryptocurrencies available for trading.

- Fractional shares trading which allows users to trade in any securities regardless of price or budget.

- Recurring investing which helps users make automated trades at a specific date each month to take advantage of volatility and employ dollar-cost averaging.

- Cash management, including debit cards, helps users efficiently save or spend their cash and earn interest.

- Robinhood Gold – a monthly paid subscription service that enables users to access margin investing, professional research, and other premium features.

- IPO Access – This is a feature that enables Robinhood users to participate in IPOs. With IPO access, users can buy shares at the IPO price before trading on the public exchanges begins.

- Robinhood Learn – On their website, Robinhood educates investors on options trading and the risks involved.

How does Robinhood make money?

Like I mentioned earlier, Robinhood was the pioneer of commission-free trading. So, if trading using Robinhood’s app is free, how does the company make money? Well, the company had to be creative and has built several revenue streams:

1. Payment for order flow(PFOF)

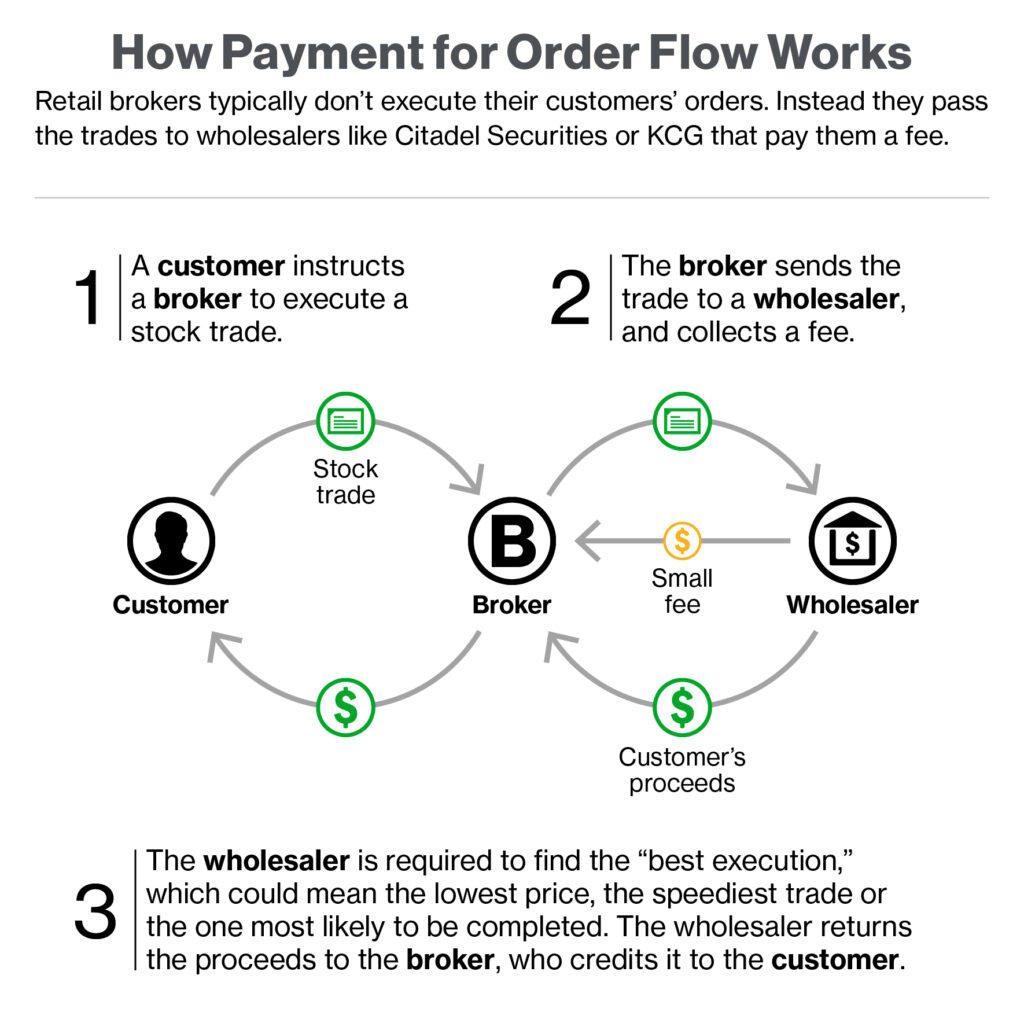

Robinhood and other online brokers don’t execute trades themselves. Instead, they forward these orders to larger financial institutions, like Citadel, and get paid for it.

“With respect to equities and options trading, such fees are known as PFOF. With respect to cryptocurrency trading, we receive Transaction Rebates.” – Robinhood’s S-1 document.

Below is an illustration of how pfof works.

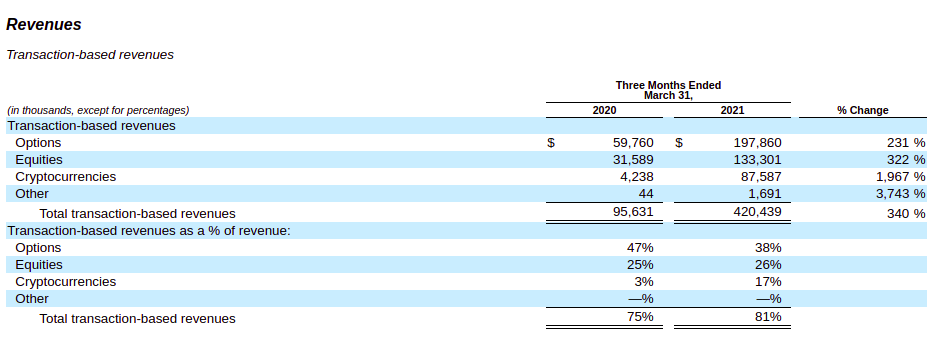

Also referred to as transaction-based revenue, PFOF is Robinhood’s leading source of revenue (75% of net), yet the most controversial one (more on this later). Here’s a breakdown of the transaction-based revenue as a percentage of revenue:

| Options | 38% |

| Equities | 26% |

| Cryptocurrencies | 17% |

2. Interest

Robinhood earns interest on margin loans offered to users as well as uninvested cash held in users’ accounts.

3. Robinhood gold subscription

Robinhood gold is a $5 per month service that provides premium features on the Robinhood app. The features include access to margin trading and professional stock research and analysis.

4. Securities lending

Securities lending is another way Robinhood makes money. It’s where clients’ stocks are loaned out to a third party for shorting purposes at a fee.

Robinhood Financials

Year Ended December 2020

In 2020, Robinhood grew its total revenue by 245% to $959 million compared to $278 million in 2019.

At the bottom line, the company recorded a net income of $7 million compared to a net loss of $107 million the previous year.

Q1, 2021

Heading straight to the bottom line, we see that Robinhood recorded a shocking loss of $1.44 billion. However, this included a $1.5 billion fair value adjustment to their convertible notes and warrant liability.

Robinhood’s Q1 revenue stood at $522 million, which included 420 million in transactional revenue, 62 million in net interest revenue, and 39 million in other revenues.

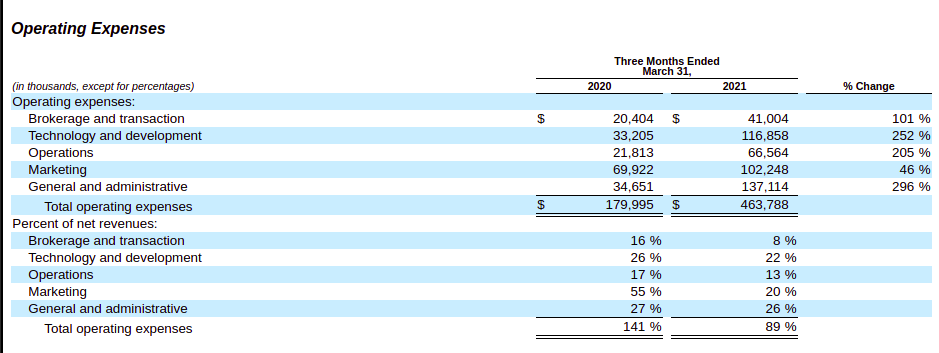

Onto operating expenses and the company’s expenditures rose to $463 million compared to $179 million in the same quarter last year. It represents a 158% increase year-over-year.

If we disregard the convertible notes and warrant liabilities, Robinhood becomes profitable with an income of $58 million.

Robinhood Valuation

Robinhood has elicited a great deal of interest from Wall Street over the last year. This is due to a flood of new customers to Robinhood’s platform since the pandemic began.

In September 2020, the company was supposedly valued at $12 billion. By the end of the year, the figure had risen to $20 billion.

Fast forward to July 2021, and Robinhood is going through turbulent times as it’s saddled with a $70 million record-setting fine by FINRA for misleading customers.

Nevertheless, Robinhood shares trading in the secondary market show that the company is on course to go public at a valuation of $35 billion.

Should you invest in Robinhood IPO? Reasons not to invest.

1. Anticipated regulation of PFOF

PFOF are the payments Robinhood receives for routing its customers’ trades to third-party financial firms for execution rather than directly to stock exchanges.

These payments enable brokerages to offer commission-free trading to their customers.

However, PFOF is banned in countries like Canada and the UK.

But why? Isn’t it a win-win for everyone? Customers get commission-free trades, and brokerages find a way to earn revenue, right?

Well, regulators are concerned that order flow payments introduce a conflict of interest in that they discourage brokerage firms from obtaining the best trades for their customers. Here’s an example of how that might be:

If, for instance, you place a market order to sell 100 shares of stock Z currently selling at $100 per share, your brokerage will forward your trade to a market maker like Citadel. Immediately after your trade is forwarded, the market price drops to $99.95 per share, and at the same time, Citadel notices another person’s limit order to buy 100 shares of stock Z at 100.05 per share. So Citadel sends your sell order to fulfill the buyer’s limit order at $100.05, making a $10 profit. Citadel keeps part of the $10 and sends part of it to the brokerage as payment for the order flow.

So, where’s the controversy? It comes in when the buyer and the seller have to give away the $10 that one of them could have easily kept. So, even though brokerages like Robinhood might seem to offer “free” trading, you may be paying in another non-traditional way.

PFOF being the largest source of revenue for Robinhood, poses a massive risk for the company’s survival if regulators decide to restrict the practice or end up banning it altogether.

2. Robinhood’s woes

A couple of weeks ago, the Financial Industry Regulatory Authority(FINRA) slapped a $70 million fine on Robinhood for its misleading communication and systemwide outages. FINRA maintains that Robinhood failed to maintain its system and neglected its duty to supervise options trading on its platform, leaving users to navigate high-risk trading by themselves. These failures, FINRA claims, caused widespread and significant harm to its customers.

The suicide of Alexander E. Kearns in June 2020 is probably the most unfortunate event caused by Robinhood’s failure to maintain its technology. The 20-year-old University of Nebraska student took his own life after seeing a negative cash balance of $730000 on his Robinhood margin account. It was later discovered to be due to a temporary system glitch. The Kearns’ family filed a lawsuit which Robinhood later settled privately.

In December 2020, The Securities and Exchange Commission(SEC) charged Robinhood with misleading customers about its revenue sources from third-party firms for routing customer trades. In addition, the SEC argued that Robinhood failed to satisfy its duty of seeking out the best execution terms for its customers’ orders. To settle the charges, Robinhood paid $65 million.

3. Will Robinhood IPO turn out to be like Coinbase?

It is my opinion that the two companies are incomparable, first and foremost because the Coinbase IPO was a direct listing and allowed existing insider shareholders to dump their shares on IPO day. On the other hand, Robinhood IPO will be the traditional kind where shareholders will not be able to sell their shares for a certain period of time.

Secondly, we don’t expect Robinhood to follow the same trajectory as Coinbase because Coinbase revenues are dependent on two risky factors: transactional revenues and the price of cryptocurrencies. Cryptocurrency prices have been on the decline, while transactional revenues are expected to contract as commissions decrease due to competition. Meanwhile, Robinhood revenues do not heavily rely on crypto, and their transactional revenues should be on the slow and steady rise as more users sign up.

Now, the above reasons are only my opinions, and many people think that Robinhood IPO could end up in a disaster, just like Coinbase.

4. Retaliation from retail investors after the Gamestop saga

It’s no secret that there’s considerable pent-up resentment towards Robinhood from the retail investor community after the Gamestop saga.

Back in January, when retail investors thought they finally had a chance to beat Wall Street at its own game, Robinhood decided to freeze all Gamestop trading.

Now, it wouldn’t come as a surprise if these investors rose in revenge when Robinhood launches its IPO.

5. Poor Customer service and growing competition

Robinhood’s customer service leaves a lot to be desired. Customers have expressed their frustrations with the company’s lengthy delays in resolving account issues, with others claiming that they could not access their money for months.

To make matters worse, new brokerages like Webull and Public are giving Robinhood a run for their money. As a result, disgruntled customers quickly find better alternatives as competition in the commission-free brokerage space intensifies.

Conclusion

To invest or not to invest, that’s the question, right?

For me, Robinhood is a stock I would like to own at some point.

The company’s competitor, Interactive Brokers, recently reported staggering Q2 earnings. And if those results are anything to go by, Robinhood – and other commission-free brokerages – should be making money hands over fist for the next couple of years, making Robinhood extremely attractive.

On the other hand, there seems to be a lot of FUD(Fear, Uncertainty, and Doubt) surrounding the company’s IPO. While IPOs are risky, Robinhood’s seems a tad riskier as there’re already a large group of people hell-bent on shorting the stock immediately it hits the market. Other risks, such as a ban of PFOF, are also worth considering.

At this point, I’ll be staying away from the IPO to see how it all plays out. When the commotion is over, I’ll be seeking a suitable entry point for a long-term position.

How about you? Do you plan to invest in Robinhood? Let me know in the comments.

Disclaimer: None of this is meant to be construed as financial advice, it’s for entertainment purposes only. Links may include affiliate referrals and I may receive compensation from partnering websites. The content is accurate as of the posting date but may not be accurate in the future.